Share

Welcome to Shaper Impact Capital’s series of articles showcasing impact startups doing amazing things around the world. Here, we would be diving into GreenArc Capital, a Singapore-based AI-driven alternative lending platform that extends credit facilities to vulnerable populations and MSMEs who do not have access to financial services.

In conversation with: Rony Palathinkal, Co-Founder and COO of Greenarc Capital

UNSDGs: #1: No Poverty / #2: Zero Hunger / #5: Gender Equality / #8: Decent Work & Economic Growth / #13: Climate Action

Looking to fundraise: $2,500,000 (Pre-Series A)

The Problem: With inequality levels at all-time highs, a global health pandemic, and more frequent and intense climate induced natural disasters, the vast amount of private capital available needs to be harnessed and directed towards addressing the financing gaps of the world’s most pressing social and environmental issues.

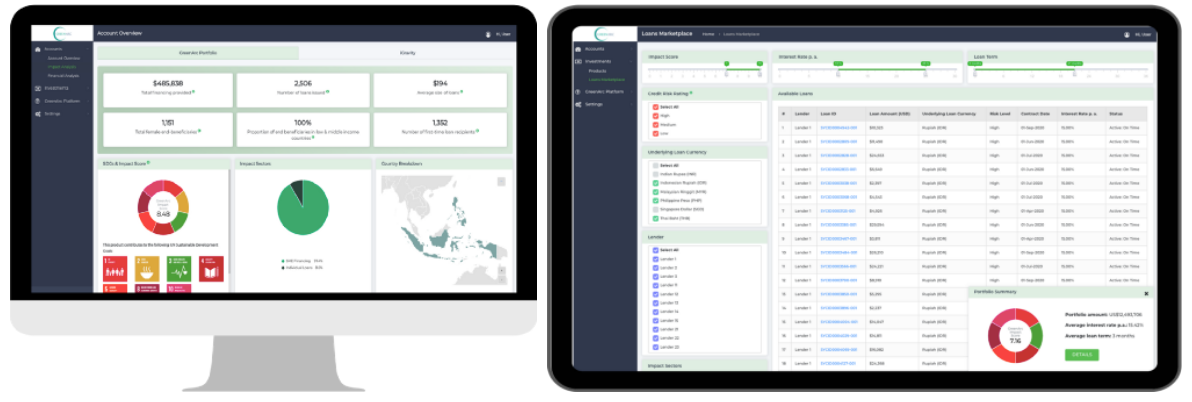

The Solution: To meet the exponential rise in demand for sustainable finance and impact investing from investors, and direct them towards true societal and environmental investment opportunities, we have developed a scalable, mission-aligned digital platform. Our platform offers institutional and accredited investors social debt investments customised according to their risk, return, and social objectives. The AI data-driven approach allows us to target specific vulnerable groups and sectors and achieve impact by:

- Identifying key social financing gaps that require funding

- Directing otherwise untapped private capital towards these gaps

- Providing granular and transparent impact measurement and reporting for all investments

The Market: Currently 50% of all global assets, ~US$80 trillion, are invested in ESG/impact assets. This is predicted to grow to ~95% by 2030. Coupled with the expected wealth transfer of US$68 trillion to the socially conscious millennial generation, these assets will drive the market growth in demand for ESG investments.

The Team: Bikram Chaudhury, founder and CEO, and Rony Palathinkal, co-founder and COO, are both ex-Credit Suisse professionals who have executed $1Bn+ in impact Investments. Together with Naveen Agnihotri, CTO, and Meeta Misra, Head of Impact and Outreach, they have a 14 member team with expertise across credit, risk, technology, and impact.

Recent Success:

- Appointed Fund Advisor¹ to a $50M private debt impact fund in partnership with a $2B AUM Singapore family office, aggregating impact assets across India and SEA through fintech lenders. This fund is being launched in Q1 2021, aimed at promoting financial inclusion in the region.

- The launch of our Impact SaaS product to report impact scores and metrics for investment portfolios, bringing transparency and standardisation to impact measurement. We currently have two active clients using the solution.

¹subject to regulatory approvals

Recent Challenges:

- Talent acquisition with data science, impact, and credit risk skills.

- Automating our impact methodology and implementing the credit risk module.

Why we love GreenArc Capital: Their platform has a clear focus on impact, as they provide users with an impact module that uses GIIN IRIS+ metrics to measure the impact of their debt portfolio. GreenArc Capital also operates in a rapidly growing market with increased capital inflows into ESG/ impact, and is headed by a strong team with abundant experience in credit, impact, and technology.

Catch GreenArc Capital on: LinkedIn